Financial Literacy – The Smith Family

The Project

Our client delivers Certificate I in Financial Services to cohorts in schools across Australia. They were seeking to modify the course content and delivery model to ensure it is:

- Relevant to a young person’s context

- Engaging

- Effective in developing meaningful understanding of basic financial concepts for young people

The Work

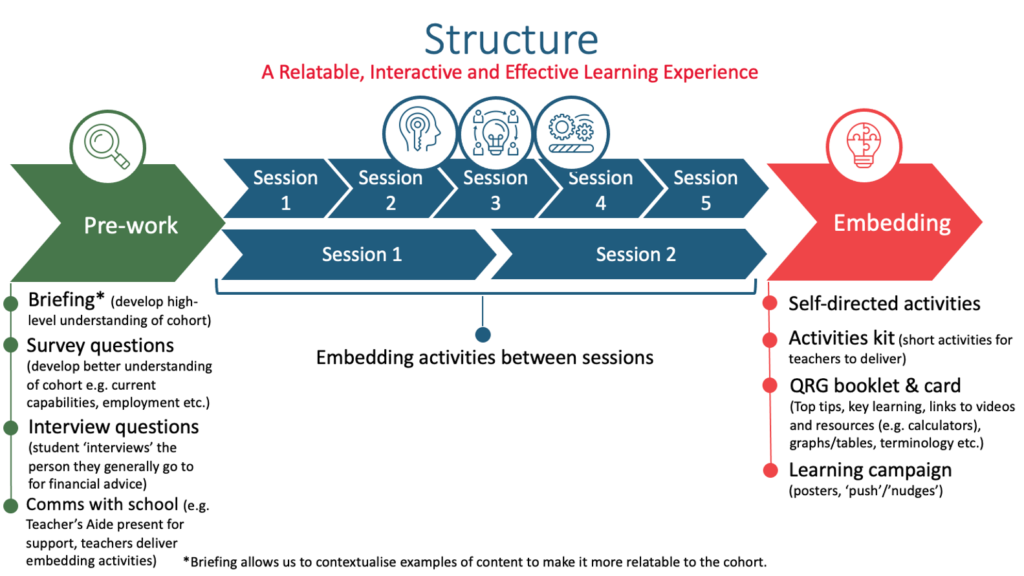

The High Level Design (HLD)

Instruction Design Australia (IDA) and Discover Learning Design’s (DLD) team of consultants created a High Level Design (HLD) – a skeleton design of the program outlining learning methodologies, objectives, and learner experience. It summarised the topics, sequence, timing, learning outcomes, activities, and resources. In addition, it outlined the game concept and initial ‘mock-up’ to provide a look and feel of what we were thinking.

Once approved, we began developing the program.

The Program

The program engages students by using application-based, contextualised, real-to-life learning experiences.

The sessions are designed to create a safe, risk-free environment where students draw on their own insights to create new, real-to-life meaning and ‘sticky’ learning.

Each session follows a similar structure:

- Play the game to get students engaged. Introduce a learning prompt.

- Introduce content through a video.

- Deliver, discuss and debrief content – ask questions, provide analogies with tangible objects, examine tables/graphs etc.

- Apply learning through contextualised scenarios and activities that are relevant to learners. Provide extension activities for high-achievers.

- Apply learning to the game by making decisions based on new insights and experience the consequences of their decisions.

The Game

We developed a game where students apply their understanding by managing their character’s finances. Players ‘earn’, ‘spend’, and ‘save’ money across the program. Chance cards and ‘unplanned situations’ are used to reflect life’s up and downs and the impacts of money management.

Players develop a budget, set their own savings goals, and track their progress. They respond to chance cards that see them use money and experience the consequences of their decisions.

New concepts that are introduced in each session are then applied in the game.

The game also acts as an opportunity for students to provide meaningful and reliable evidence to contribute towards assessment decisions (repeated demonstration of competence), reducing dependence on completing the current assessment book.

Videos

We developed eight animated videos to introduce new concepts. They are around 2-4 minutes – enough to develop a basic understanding of the topic whilst maintaining students’ engagement.

Learning Materials

We developed the following materials to support the delivery of the program:

- Facilitator Guide/Session Plan

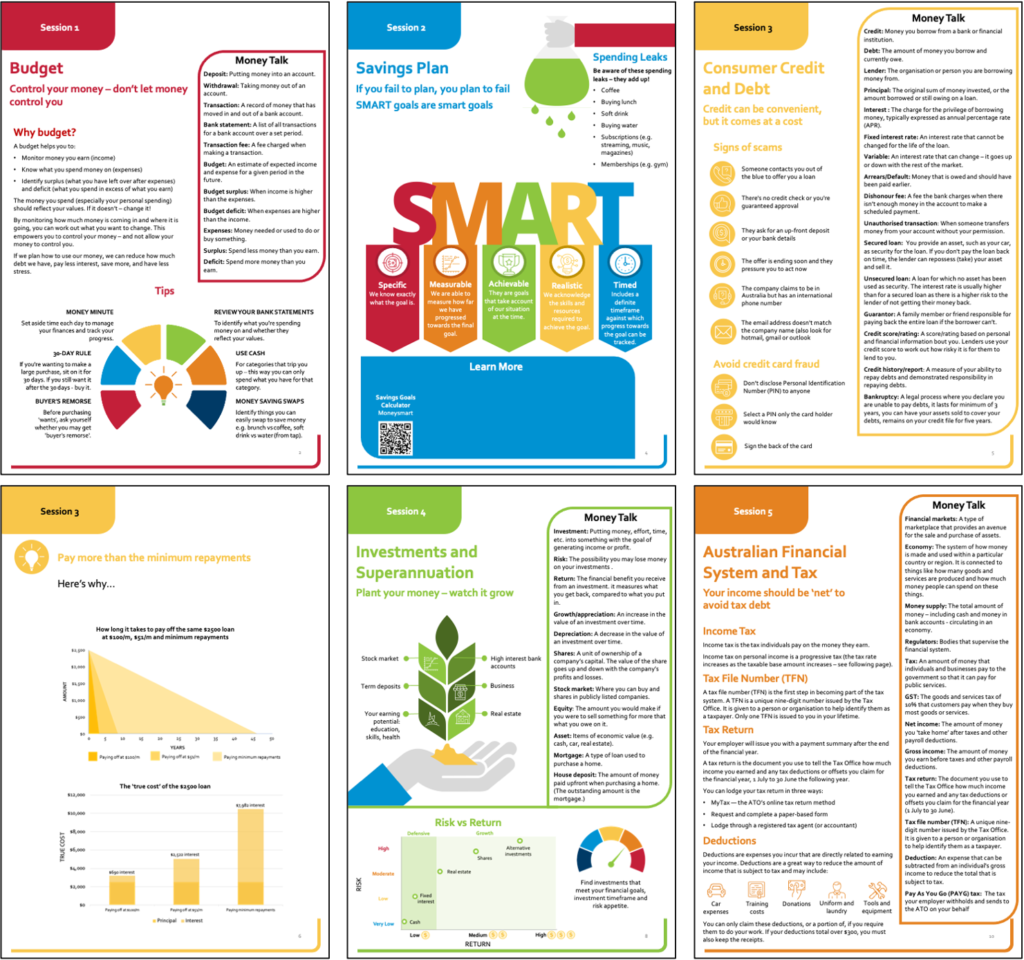

- Money Guide QRG Booklet – summarises key content from the program that students can take home

- The Game – including game board, character tokens and character profiles, chance cards, items to purchase at the shop, instructions, budget planners/money trackers

- Animated videos

- Student Workbook

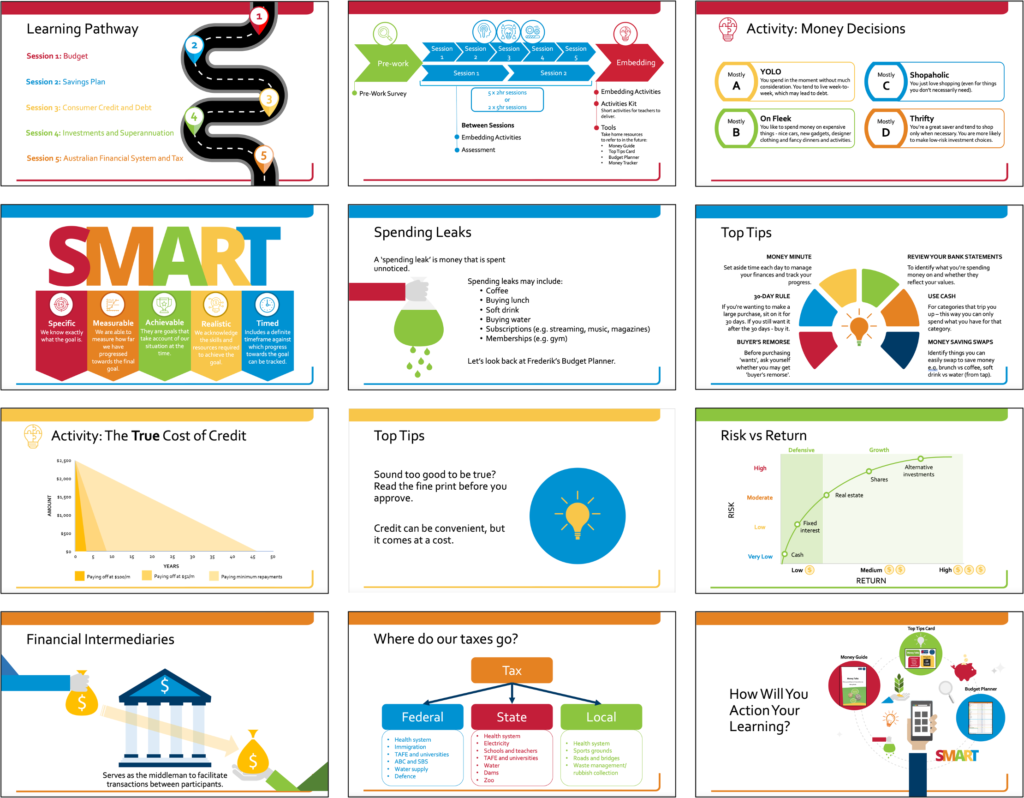

- PowerPoint Presentation

- Assessment Book, Marking Guide and Mapping (AQF Compliant)

- Teachers Guide – includes embedding activities that can be delivered in the classroom

- Top Tips Card – a card with top tips from the course that students can keep in their wallet

- Budget Planner/Money Tracker – an excel spreadsheet that students can take home to manage their own budget

- Program evaluation tools

The Outcome

IDA and DLD developed a program that will empower learners to control their money by developing an understanding of finance and an awareness of the potential impacts of your decisions.

The gamification of financial literacy, along with the QRG, Budget Planner, and other tools, will lead to longer-term retention and application of knowledge and skills.

Samples

High Level Design – Learning Architecture and Sequence

Animated PowerPoint Presentation

Quick Reference Guide (QRG) Booklet

Quick Reference Guide (QRG) Booklet

Contact Us

Contact Details

Office

E: info@discoverlearning.com.au

Ph: 1300 528 736

Michael Peart

E: michael@discoverlearning.com.au

Ph: 0434 075 231

Bianca Schimizzi

E: bianca@discoverlearning.com.au

Ph: 0416 013 623